Application of Machine Learning for Predicting U.S. Bank Deposit Growth: A Univariate and Multivariate Analysis of Temporal Dependencies and Macroeconomic Interrelationships

Main Article Content

Abstract

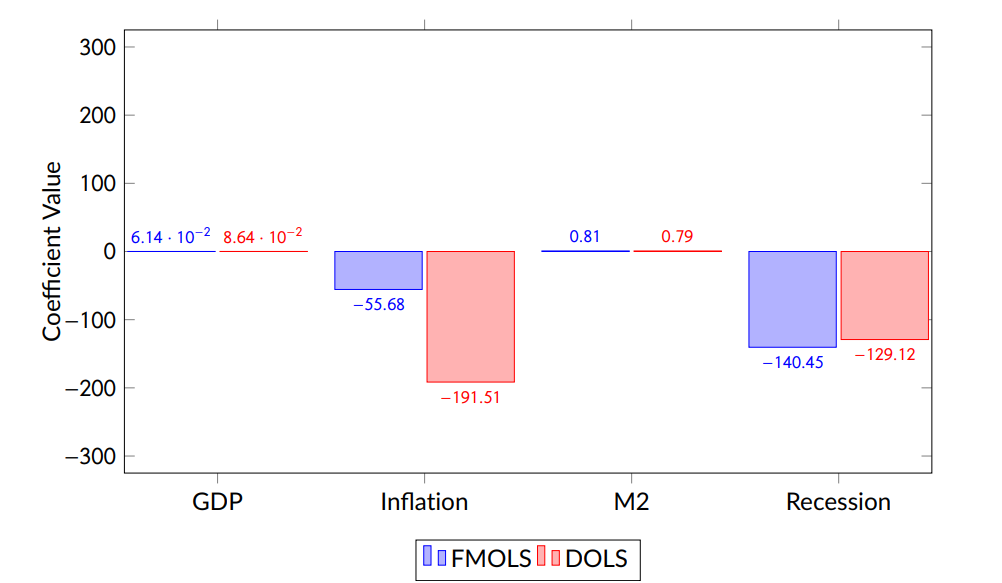

This research applies machine learning algorithms to predict the growth rates of bank deposits in the United States using data from 1973 to 2019. The dataset includes weekly deposit records from U.S. commercial banks and key macroeconomic indicators, including GDP, inflation, money supply (M2), recession periods, and interest rates, obtained from the Federal Reserve Economic Data (FRED). The study involved preprocessing steps including date conversion, stationarity testing with the Augmented Dickey-Fuller (ADF) test, and differencing to achieve stationarity. Various models were tested for univariate time series analysis, including SARIMA, Prophet, ETS, LSTM, and Transformer models. LSTM demonstrated the highest predictive accuracy, with the lowest error metrics and the highest R² value, proving effective in capturing complex temporal dependencies in deposit data. The study conducted a multivariable analysis incorporating several macroeconomic indicators to explore their relationship with bank deposits. This process included feature scaling, creating lag features, and preserving temporal order during data splitting. Recurrent Neural Networks (RNNs) were evaluated with different lagged periods to assess their impact on model performance. The results indicated that while increasing the number of lags improved the model’s fit to the training data, it did not consistently enhance performance on unseen data, highlighting the trade-off between model complexity and generalization. Cointegration analysis confirmed long-term equilibrium relationships between bank deposits and macroeconomic indicators. Further analysis using FMOLS and DOLS revealed that inflation and recessions negatively impacted deposits, while M2 and GDP had positive effects. This study demonstrates the effectiveness of machine learning models, with LSTM proving particularly successful in forecasting bank deposit growth rates. Incorporating multiple macroeconomic variables significantly enhanced predictive accuracy, providing valuable insights into the factors influencing deposit levels. This research contributes to financial forecasting by showcasing the ability of machine learning techniques to integrate economic dynamics into predictive models. This research contributes to the field of financial forecasting by demonstrating the efficacy of machine learning techniques in economic analysis.

Article Details

Public Licensing Terms

Thank you for your interest in our published work. We are committed to promoting open access and the free dissemination of knowledge. In line with this, we have established the following public licensing terms that govern the use and distribution of our published works:

-

Creative Commons License: All our published works are licensed under the Creative Commons Attribution-NonCommercial-ShareAlike (CC BY-NC-SA) license, unless otherwise specified.

-

Permissions Granted: a) Attribution: You are free to share and adapt the work, provided that you give appropriate credit to the author(s) and provide a link to the original source. b) NonCommercial: You may not use the work for commercial purposes without obtaining explicit permission from the copyright holder. c) ShareAlike: If you remix, transform, or build upon the work, you must distribute your contributions under the same CC BY-NC-SA license as the original work.

-

Compliance with License Terms: When using or distributing our published works, you must comply with the terms of the CC BY-NC-SA license and ensure that proper attribution is given to the original author(s).

-

Commercial Use: If you wish to use our published works for commercial purposes, you must seek permission from the copyright holder. Please contact us at [insert contact information] to discuss commercial licensing options.

-

Third-Party Rights: Our published works may contain third-party content or materials. The licensing terms for such content may vary, and you are responsible for complying with any additional terms or restrictions imposed by the respective copyright holders.

-

Disclaimer: The published works provided under these licensing terms are intended for informational and educational purposes only. We do not guarantee the accuracy, completeness, or suitability of the content, and we shall not be held liable for any errors, omissions, or damages arising from the use of the published works.

-

Termination: We reserve the right to terminate or modify the licensing terms for our published works at any time without prior notice. However, any works published prior to the modification or termination will continue to be governed by the original licensing terms.

By accessing, using, or distributing our published works, you acknowledge and agree to be bound by these public licensing terms. If you have any questions or require further clarification regarding the licensing terms or permissions, please contact us at permission@publications.dlpress.org

Last updated: 05-02-2023